SBA Helps Revive Small Businesses

Cary, NC — This month’s Cary Chamber Eye-Opener featured guest speaker Thomas A. Stith, District Director of the Small Business Administration.

Virtually joining the Chamber event from Charlotte, Stith gave his perspective on the challenges facing small businesses in NC and what assistance is available to help them move forward.

SBA’s COVID-19 Response

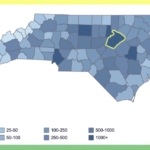

There are more than 900,000 small businesses in North Carolina, employing an estimated 1.7 million people. The financial recovery response efforts from the SBA began on March 18, 2020, when the administration made a declaration of disaster.

“North Carolina is very familiar with hurricanes, forest fires and damaging storms but this is the first time, at least in modern history, that all 100 counties were declared a disaster,” said Stith.

This declaration set the SBA’s response in motion in the form of several loan programs. Since their mid-March declaration, the SBA has approved over 111,000 loans in North Carolina, amounting to over $12.2 billion in financial support for small businesses.

The Paycheck Protection Program (PPP)

This program was designed to provide financial support for small businesses and nonprofits and was put into action with the passing of the $2 trillion federal CARES Act on March 27, 2020. This program’s key differentiator is that it has a forgivable clause. This clause serves as an incentive, according to Stith, for businesses to maintain their current employees and also cover other eligible expenses of rent, utilities, lease payments and even mortgage interest.

But — as with any clause, there are rules.

For small businesses to qualify for loan forgiveness, they have an 8-week window after receiving the loan funds. During this window, the business must use at minimum 75% of the total PPP proceeds for payroll. The additional money, 25% or less of the total, can be used for other allowed operating expenses. This additional money could cover rent, utilities, lease payments and even mortgage interest.

Stith’s biggest piece of advice for businesses taking part in a PPP loan — utilize the forgivable clause.

“In many cases it could eliminate the loan or significantly reduce the amount of loan that would then go into the 2-year, 1% interest term,” said Stith.

The program is now in its second round and as of May 27, 2020, there is a little over $100 billion to be doled out. Businesses must apply through a local lender such as a bank, credit union or fintech company. In this second round, Stith says the turnaround time from application to receiving funds has been a couple of days to one week.

The Small Business Debt Relief Program

This program was also included in the CARES Act in late March. Stith said this particular initiative has proven to be a very significant benefit for existing SBA loan holders.

“This provides for six months of interest and principal payments on existing SBA loans,” said Stith. “So, if you’re a business that has a 7a or 504 loan, those payments for six months can be deferred by the business and actually paid for by the SBA.”

Economic Injury Disaster Loan Program (EIDL)

The EIDL program was launched before the passage of the CARES Act with loans available starting March 18, 2020. This is a program NC businesses have worked with in past where loans are designed to provide general operating expenses post-disaster.

Stith explained that these loans and PPP loans work hand-in-hand, but are different. PPP funding is given through a relationship with a business’ local lender while EIDL funds are directly sourced and handled with the SBA.

“These loans can have a term of up to 30 years. For small businesses, the rate would be 3.75% and 2.75% for non-profits,” said Stith.

After the March 27 CARES Act was passed, an additional benefit became available under this program in the form of an additional emergency advance. This advance is in the form of a grant with a maximum of $10,000. The rule of thumb for this grant is $1,000 per employee, up to $10,000. If approved, these funds are distributed first according to Stith.

For more details on these loan programs, visit the SBA website.

The Outlook for NC Small Businesses

Mark Lawson, the Chamber’s Vice President of Economic Development, provided Stith with questions from Cary’s business community. One specifically asked for Stith’s personal outlook on the health of small businesses for both the entrepreneur looking to start one up and the owner who’s in business and trying to recover. Here’ what he had to say.

“I’m very encouraged as we look forward, but clearly our small business communities have been impacted significantly and there is going to be a time period for recovery. What we’re seeing across the state is that resiliency that North Carolina represents, in particular in the entrepreneurial and innovation sectors.

Let’s not forget in North Carolina, the 9th largest state in the country, we have a very storng foundation in our business environment. We are going to bounce back and we are already seeing that. As I look forward, I see the entrepreneurial spirit kindled across the state, I see small businesses accessing the current and future markets, I see small manufacturers who have changed and expanded their capabilities to make masks and other PPE.

If I’m an existing small business, I would utilize this time to access what was my 2-year and 5-year plan? How does it need to change? There are numerous resources to work with you as you look forward and I would encourage you to utilize those resources as you plan for this recovery.”

To access these resources as a current or prospective small business owner, visit the SBA’s Local Assistance page.

Story by Ashley Kairis. Images screen-captured from the Zoom meeting.

All the Cary news every day since 2009. Subscribe.